First step towards your Banking Career

Your Search for the BANK JOB ENDS HERE !!!

RETAIL BANKING

start your banking career with 3 big advantages

THE POWER OF KNOWLEDGE

THE GUARANTEE OF ACCEPTANCE

THE OPPORTUNITY OF EMPLOYMENT

BANKING EXECUTIVE PROGRAM

A program widely appreciated, Approved and Accepted by the industry leaders. With an eye on the future and a finger on the pulse of the present, We offer a job-oriented banking knowledge modules called Banking executive program.

BEP is designed for a candidate who is willing to start their career in private sector bank and financial organisation. A classroom training module, enriched with content developed by senior bank professionals. It is simply a must-have for everyone who is looking to start a career in the banking and financial service sectors.

Compelling Reasons to Choose Banking as a Career Option

- Job Satisfaction

- Customer-facing Roles

- Extensive Learning

- Self Confidence

- Perks and Benefits

- Stable and Secure Industry.

- Exposure to the latest Technologies

- Opportunities for Professional Development

- Variety of Roles and Specializations

- Job Security

- Job Diversification

Are you a young graduate?

ADMISSION CRITERIA

Any Graduate

Below 30 Years Of Age

Communication

Skills

Fresher Or

Experienced

PLACEMENT ASSISTANCE

India’s BFSI sector is poised for a quantum growth. This sector offers immense career opportunities for qualified, trained and quality professionals.

BEP certified professional could explore career opportunities in BFSI & NBFC as a Cashier / Teller, Branch operation, Backend operations etc

25+ Recruiters

5000+ Aspiring Candidates

4900+ Placements

For those planning to make a Rewarding career in Banking

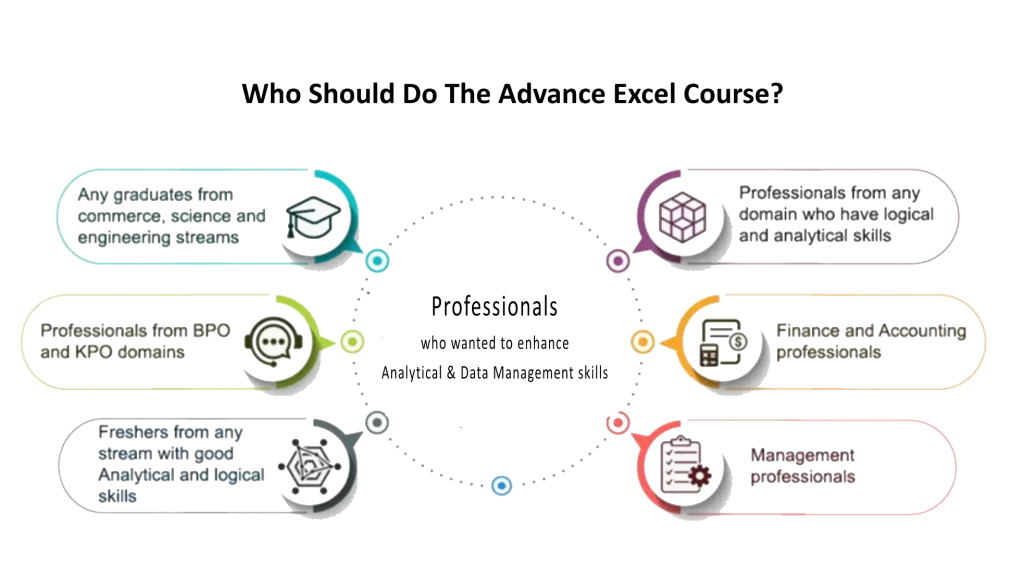

ADVANCE EXCEL

Beginner to Advanced

Furthermore, the course teaches how to automate repetitive tasks using macros, adding value by saving time and reducing errors. This comprehensive course empowers individuals to manipulate data with confidence and streamline their Excel-based processes.

Components of Program

Module 1

Getting to Know Excel

- The Work Surface

- Navigation

- First File

- Formatting

- Basic Math

Module 2

Essential Formula Knowledge

- Formula Anatomy

- Cell Referencing

- Function Anatomy

- Math Functions

- Basic Statistics

- Logic Functions

- Text Functions

- Understanding Dates

- Understanding Time

Module 1

Getting to Know Excel

- The Work Surface

- Navigation

- First File

- Formatting

- Basic Math

Module 2

Essential Formula Knowledge

- Formula Anatomy

- Cell Referencing

- Function Anatomy

- Math Functions

- Basic Statistics

- Logic Functions

- Text Functions

- Understanding Dates

- Understanding Time

Module 3

Intermediate Formula Knowledge

- Formula Auditing

- Conditional Math

- External Links

- Temporal Functions

- VLOOKUP with Exact Match

- Other Lookup Methods

Module 4

Optimizing Data

- Sorting

- Filtering

- Contiguous Data

- Naming Ranges

- Excel Tables

- Recording Macros

Module 5

Data Analysis

- Creating Pivot Table

- Formatting Pivot Tables

- Calculated Fields in Pivot Tables

- What-If Analysis

Module 6

Presenting and Reporting

- Cell Formatting

- Outlining

- Custom Number Formats

- Conditional Format with Build-In Rules

- Conditional Format with Custom Rules

- Building Column Charts

- Building Bar Charts

- Building Pie Charts

- Building Line Charts

- Building Combination Lines and Area Charts

Module 5

Data Analysis

- Creating Pivot Table

- Formatting Pivot Tables

- Calculated Fields in Pivot Tables

- What-If Analysis

Module 6

Presenting and Reporting

- Cell Formatting

- Outlining

- Custom Number Formats

- Conditional Format with Build-In Rules

- Conditional Format with Custom Rules

- Building Column Charts

- Building Bar Charts

- Building Pie Charts

- Building Line Charts

- Building Combination Lines and Area Charts

Module 7

Validating and Updating

- Data Validation

- Data Validation Lists

- Comments

- Styles

Module 8

Preparing to Deploy

- Custom Views

- Page Setup Options

- Security Considerations

ADVANCED EXCEL CERTIFICATION

Aptitude

Aptitude tests are increasingly administered online – most often after a candidate has made their initial job application – and are used to filter unsuitable applicants out of the selection process, without the need for time-consuming one-to-one job interviews.

Employers use aptitude tests from a variety of providers – such as SHL, Talent Q and Cubiks etc. The aim is to determine a candidate’s mental capacity and how they respond to the challenges they face in their day-to-day role at a firm.

Crack Your Career

Using Our Aptitude Training

Quants

- Ratio and Proportion

- Problems on Ages

- Percentages

- Profit & Loss

- Partnership

- Averages & Mixtures

- Time & Work

- Surd & Indices

- Time and Distance

- Problems on Trains

- Data Interpretation

- Permutation & Combinations

- Probability

Reasoning

- Syllogism

- Directions

- Coding & Decoding

- Blood Relations

- Calendar

- Order & Ranking

- Alphanumeric

- Number Analysis

- Number series

Stock Market Trading

- What is stock market?

- How a company can get listed in to the Stock Market?

- Why the company wants to list into the stock market?

- Difference between investing and Trading?

- What is intraday trading?

- What is cash market, futures and options trading?

- Simple common strategy for intraday trading?

- Basics rules to pick a stock for investment purpose by in fundamental analysis.

- How to buy and sell shares in the real-time market?

- What is a settlement process?

NISM-SERIES

Examination Training

The School for Certification of Intermediaries (SCI) at NISM is engaged in developing Certification Examinations for associated persons in various segments of the Indian securities markets. These examinations are being developed by NISM as mandated under SEBI Regulation, 2007. Presently, these examinations are delivered through various Test Administrators appointed by NISM in more than 150 cities across India.

NISM Test Administrators

| S.NO | NISM EXAM | TEST DURATION | EXAM FEE | MAX MARKS | NO OF QUESTIONS | PASS MARK | NEGATIVE MARK | CERTIFICATE VALIDITY | MODE | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | NISM Series V A: Mutual Fund Distributors Certification Examination | 2 hrs | 1500/- | 100 | 100 | 50 | Nil | 3 Yrs | ONLINE | |

| 2 | NISM-SeriesV-B: Mutual Fund Foundation Certification Examination | 2 hrs | 1200/- | 50 | 50 | 50 | Nil | 3 Yrs | ONLINE | |